Loading...

The Foundation’s Investment Committee continuously reviews and adopts global best practices in the oversight of the Foundation’s portfolio.

Helping make those decisions is the Foundation’s asset consultant, JANA. JANA is an Australian, majority management-owned, independent asset consultancy, who have been operating for over thirty years and were appointed from 1 January 2021.

Foundation North sets robust benchmarks against which it assesses the performance of its investment managers over appropriate time periods. Foundation North’s total investment performance is also compared against the composite portfolio benchmark (net of investment management fees and any relevant taxes) and our target return objective of NZ CPI +.4.5%.

Investment Performance

| Performance to 31 March 2025 | Qtr | 1Yr | 3Yr | 5Yr | 7Yr | 10Yr | 05/94 Inc. |

|---|---|---|---|---|---|---|---|

| % | %pa | %pa | %pa | %pa | %pa | %pa | |

| Foundation North | -1.4 | 5.0 | 5.0 | 9.8 | 8.1 | 7.6 | 7.7 |

| Strategic Asset Allocation | -0.3 | 12.0 | 11.5 | 12.0 | 9.0 | 8.2 | 6.7 |

| New Zealand CPI + 4.5% | 2.0 | 7.0 | 8.9 | 9.0 | 8.4 | 7.7 | 7.4 |

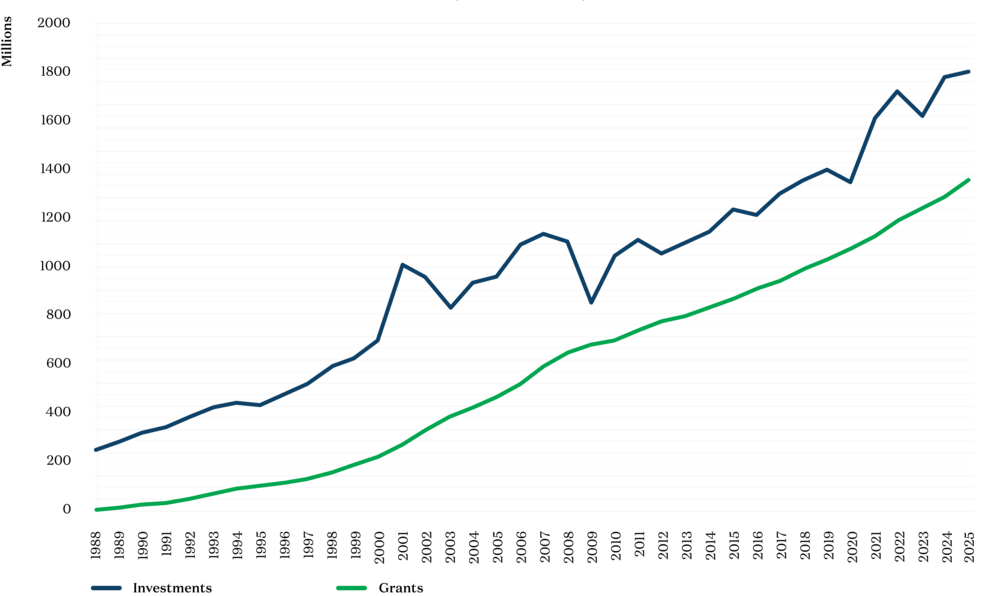

Annual Investment Portfolio Market Values and Cumulative Approved Grants Total (From FYE 1988 to 2025)